If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017.

Malaysia Needs Gst To Weather Turbulence Ahead Say Experts The Edge Markets

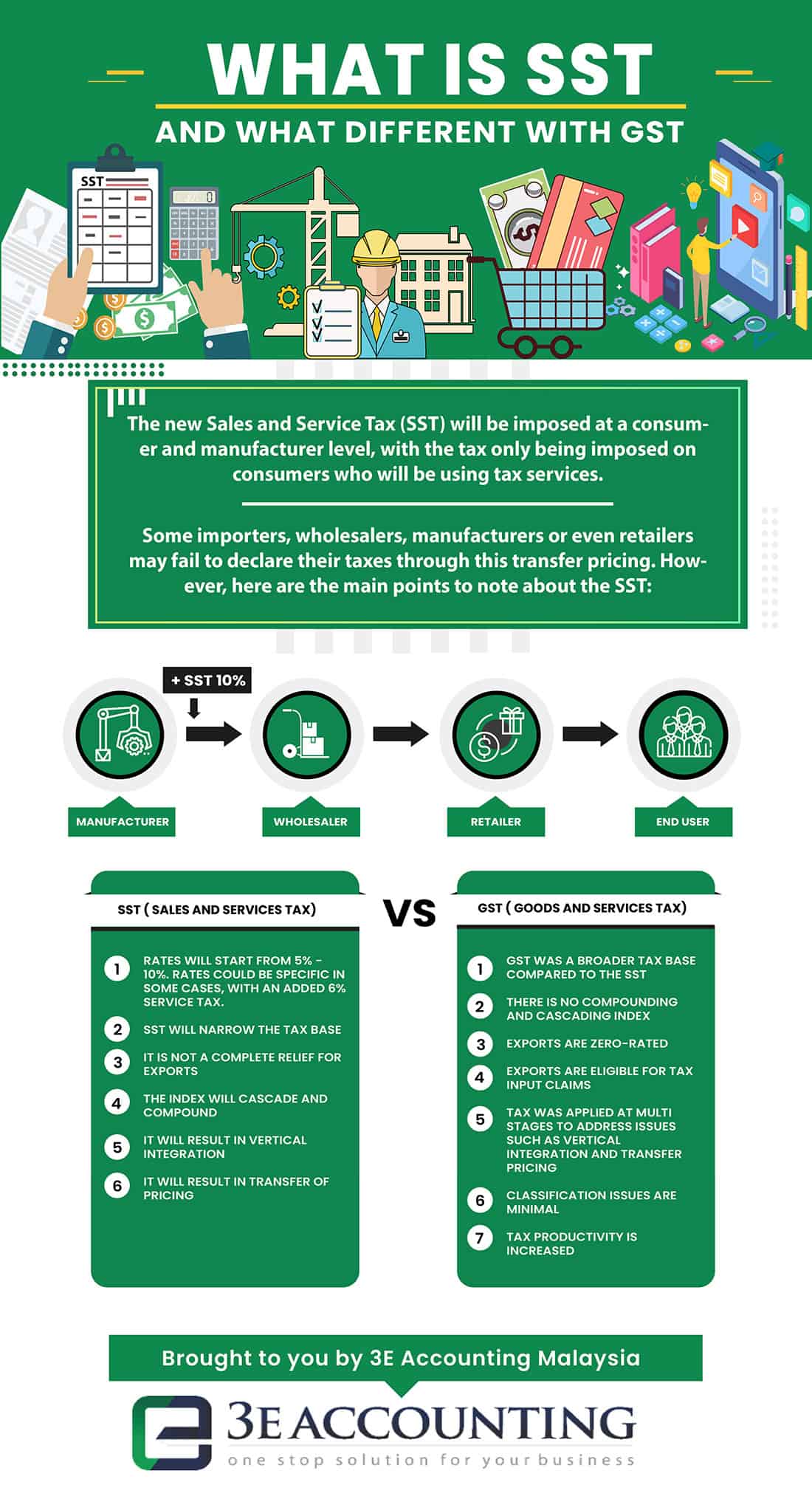

The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come.

. Malaysia needs to introduce a resilient tax regime such as the goods and services tax GST so its economy can bounce back quicker from the impact of the Covid-19 pandemic says Datuk. The Star Online delivers economic news stock share prices personal finance advice from Malaysia and world. Sales and Service Tax SST in Malaysia.

India Business News. Annexure 2 Amended Trading Manual Effective. These documents contain the Rules of Bursa Malaysia Derivatives which have been updated as at the date above.

Amendment Order 2018 GST Amendment Order Annexure 1 Amendments to the Directive. You need to keep the tax invoice for your GST records. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

Malaysia business and financial market news. Name of the Act Late fees for every day of delay. GST stands for Goods and Services Tax.

Subscribe to our RSS feeds and get the latest Bursa Malaysia news. When you buy supplies worth 50 or less its still a good idea to get a receipt. Saravana Kumar representing Petronas said in granting the order to quash the BOD the court also made a declaration that the supply of ethylene by Petronas to Idemitsu SM Malaysia Sdn Bhd ISM are exports and not supplies made in Malaysia in accordance with the purpose and spirit of the GST Act 2014.

Sources said dairy giant Amul may revise prices of these dairy products following a decision taken by the Goods and Services Tax GST Council to remove exemptions from GST on repackaged re. John can claim a GST credit of 100 on his activity statement. Taxable and non-taxable sales.

The Government will delay the planned Goods and Services Tax GST hike to 2023 and stagger the increase in two steps Finance Minister Lawrence Wong said in his Budget speech on Friday. Segala maklumat sedia ada adalah untuk rujukan sahaja. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

This zi char chain is serving up more than just food theyre dishing out service charges and goods and services tax GST as wellFuLee Seafood will be charging service charge and GST starting. The existing standard rate for GST effective from 1 April 2015 is 6. After winning the toss and bowling first Malaysia put the early squeeze on Denmarks batting line-up.

India has offered to sell 18 light-combat aircraft LCA Tejas to Malaysia the defense ministry said on Friday adding that Argentina Australia Egypt the United States Indonesia and. Many people believed that GST increased. John can also claim an amount that reflects the decline in value of the photocopier on his tax return.

What is GST how it works. In the run-up to Budget 2018 our Head of Indirect Tax Raja Kumaran discusses the need for a more resilient and sustainable GST system in Malaysia. In Malaysia corporations are subject to corporate income tax real property gains tax goods and services tax GST and etc taxes.

2 days agoCounsel S. Defending the imposition of 5 GST on food articles such as cereals rice flour pulses and curd which are pre-packaged and labeled FM Sitharaman s. A tax holiday was declared on 1 June 2018 and the GST rates were reduced from 6 to 0 which was the beginning of the transition from GST to SST.

Reducing the cost of doing business. Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021. The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018.

Central Goods and Services Act 2017. SINGAPORE Five businesses were alleged to have used the GST increase as an excuse to increase the prices of essential products and services said Minister for Trade and Industry Gan Kim Yong. 1st June 2018.

About 950000 Singaporean households living in Housing Board HDB flats will receive their second quarterly Goods and Services Tax Voucher GSTV U-Save and GSTV service and. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. The reintroduction of the Sales and Services Tax SST has kept corporates across Malaysia busy for the last three months or so.

If you want to claim the GST on these purchases you will need a record of the. John subtracts his GST credit from the purchase price 1100 - 100 GST 1000 and uses 1000 to calculate the deduction he is entitled to in his tax return. You should issue tax invoices when you sell goods or services.

GSTR 20131 Goods and services tax. In a written reply to a parliamentary question on Tuesday 2 August Gan said that the Committee Against Profiteering CAP whose role is to review and investigate. Exports of goods and provision of international services are mainly zero-rated supplies.

A GST registered entity who makes zero-rated supplies is able to claim the input tax paid on purchases. It is an Indirect tax which introduced to replacing a host of other Indirect taxes such as value added tax service tax purchase tax excise duty and so onGST levied on the supply of certain goods and services in India. The objective of abolishing the GST was to put more purchasing power in the hands of the Malaysian people especially the lower- to middle-income earners.

Tax invoices sets out the information requirements for a tax invoice in more detail. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Rs 25 Total late fees to be paid per day.

Left-arm spinner Nicolaj Damgaard took 6 for 6 in a nine-over spell which included seven maidens to help bowl Malaysia out for 151 after Denmark scored 242 for 6 in a rain-reduced 49-over contest. Selling goods or services. GST is not chargeable on exempt supplies of which there are two categories sale and lease of residential land.

In other words resident and non-resident organisations doing business and generating taxable income in Malaysia will be taxed on income accrued in or derived from Malaysia. The governments decision to impose 18 per cent GST on rental houses to be paid by tenants whose business professional income fall under the ambit of GST will put additional burden on the.

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

An Introduction To Malaysian Gst Asean Business News

Malaysia Goods And Services Tax Gst Penalties Goods Services Tax Gst Malaysia Nbc Group

Investors View Gst As Boost To Economy Says Analyst Free Malaysia Today Fmt

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Insight Oecd Recommends That Malaysia Reintroduce The Gst The Star

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Gst Better Than Sst Say Experts

Pdf Public Acceptance And Compliance On Goods And Services Tax Gst Implementation A Case Study Of Malaysia

No Decision Yet On Bringing Back Gst Says Ismail Free Malaysia Today Fmt

Gst In Malaysia Will It Return After Being Abolished In 2018

Gst Rates In Malaysia Explained Wise

Malaysian Taxation The Tasks Ahead For Sst Asia Research News

World Bank Malaysia Needs To Mobilise Its Revenue Decline

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Gst In Malaysia Will It Return After Being Abolished In 2018

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Gst More Efficient But Not Suitable For Now

- 99 nama asmaul husna dan artinya

- kota bharu lunch

- kluang bus station

- kesinambungan in english

- villaria condominium taman medan

- 1 jalan perdagangan 1 taman perdagangan parit aani yong eng

- undefined

- gst news malaysia

- tanjung golden village

- ippo hafiz hujan sepi

- surat kebenaran berkahwin di luar negara

- borang nikah di perak

- kfc annual report 2017

- flavour pod terbaik

- hearing aid malaysia price

- latihan nama bahagian-bahagian gigi

- kelebihan rambut panjang dalam islam

- fakulti bahasa moden dan komunikasi upm

- doa untuk memudahkan urusan

- new cafe in kl 2019